What Is An Off Balance Sheet Activity

Institutionsare required to report off-balance sheet items in conformance with Call Report Instructions. The use of off-balance sheet may improve activities earnings ratios because earnings generated from the.

Disposal Of Assets Disposal Of Assets Accountingcoach

Off-balance sheet activities include items such as loan commitments letters of credit and revolving underwriting facilities.

What is an off balance sheet activity. Up to 10 cash back Abstract During the past couple of decades financial institutions have sharply expanded their off-balance sheet activities. Off-balance-sheet financing refers to types of transactions and methods of accounting for transactions in which no liabilities are recorded to an organizations financial statements. Off balance sheet events are comprised of financial transactions that are not captured or disclosed anywhere on a companys balance sheet but may be.

Now off-balance sheet activities can affect the future shape of the financial institutions balance sheet thus can be a significant source of risk exposure. An item is classified as an off-balance-sheet asset when the occurrence of the contingent event results in the creation of an on-balance-sheet asset. The standards bring into broad alignment the accounting treatment for off balance sheet activities in International Financial Reporting Standards IFRSs.

Similarly an item is an off-balance-sheet liability when the contingent event creates an on-balance-sheet liability. They are either a liability or an asset which are not shown on a companys balance sheet as the business is not a legal owner of the respective item. An off-balance sheet activity does not appear on the financial intuitions balance sheet rather it is shown as a note bellow the balance sheet.

These activities create assets or liabilities that are not reflected on the balance sheet of a firm as they are contingent in nature. In many cases off-balance-sheet liabilities are simply recorded as. Off balance sheet refers to those assets and liabilities not appearing on an entitys balance sheet but which nonetheless effectively belong to the enterprise.

The financial obligations that result from OBSF are known as off-balance-sheet liabilities. By using off-balance sheet financing a company might find it easier to obtain funding through equity capital or loans. These items are usually associated with the sharing of risk or they are financing transactions.

Off-balance-sheet activities are conducted by banks to earn additional income apart from lending and deposit activities. Off balance sheet financing allows an entity to borrow being without affecting calculations of measures of indebtedness such as debt to equity DE and leverage ratios low. This trend has been fostered by the stepped-up pace of financial innovation.

The International Accounting Standards Board IASB has recently issued three standards. Off-balance sheet OBS items are an accounting practice whereby a company does not include a liability on its balance sheet. Financial innovation involves more than development and diversification of new borrowing sources.

The issuance of these standards completes IASBs improvements to the accounting requirements for off balance sheet activities and joint arrangements. Off balance sheet refers to the assets debts or financing activities that are not presented on the balance sheet of an entity. Off balance sheet refers to the assets debts or financing activities that are not presented on the balance sheet of an entity.

When investors study the financial statements of a company they give close attention to the liquidity of the company one measure of which is the ratio of debt to equity. Off-Balance Sheet OBS Also known as Off-Balance sheet items Off-Balance sheet assets or liabilities and Incognito Leverage. While not recorded on the balance sheet itself these items are.

Off balance sheet financing allows an entity to borrow being without affecting calculations of measures of indebtedness such as debt to equity DE and leverage ratios low. It includes items like letter of credit leaseback agreements etc. Off-balance-sheet activities or items are contingent claim contracts.

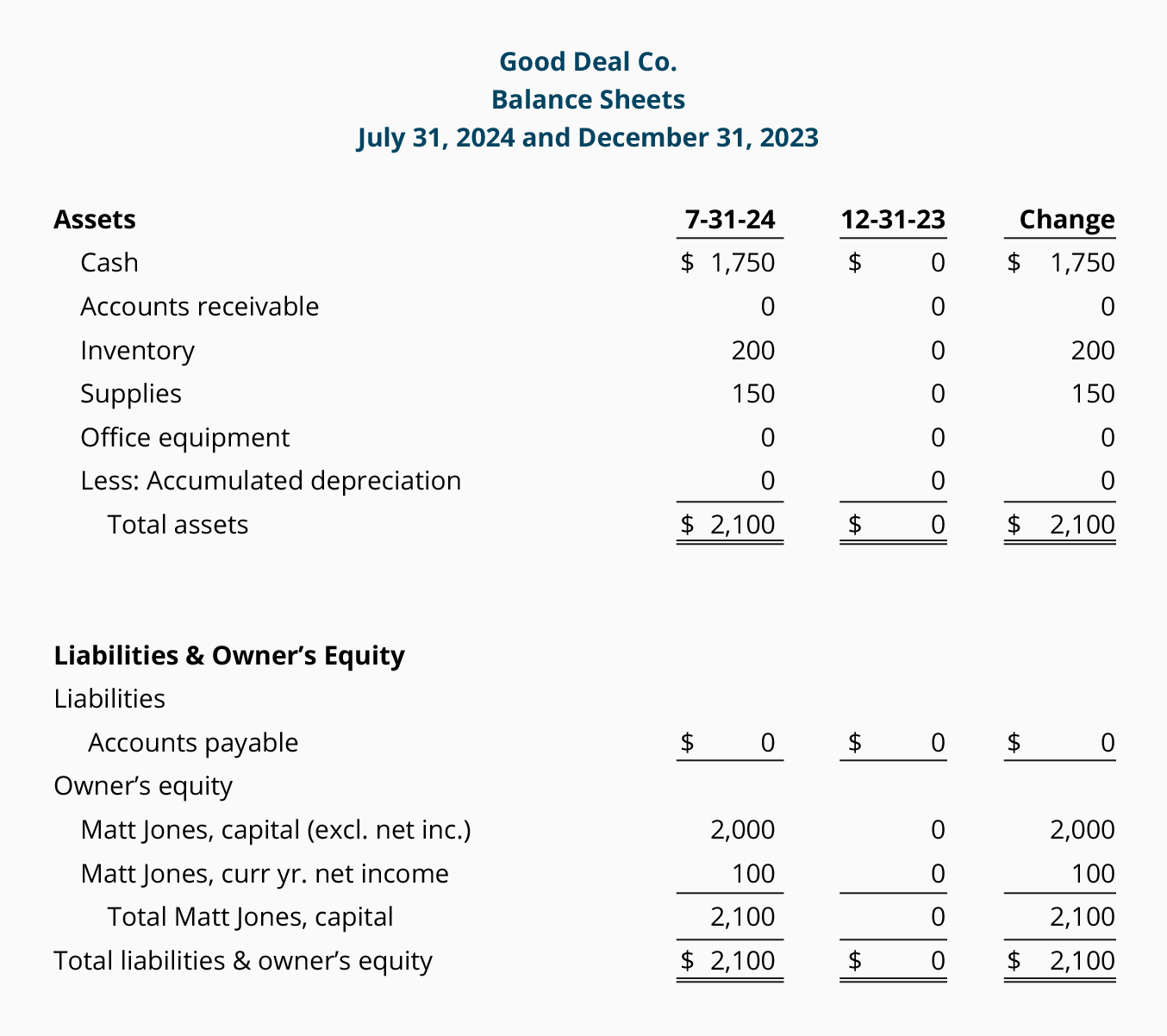

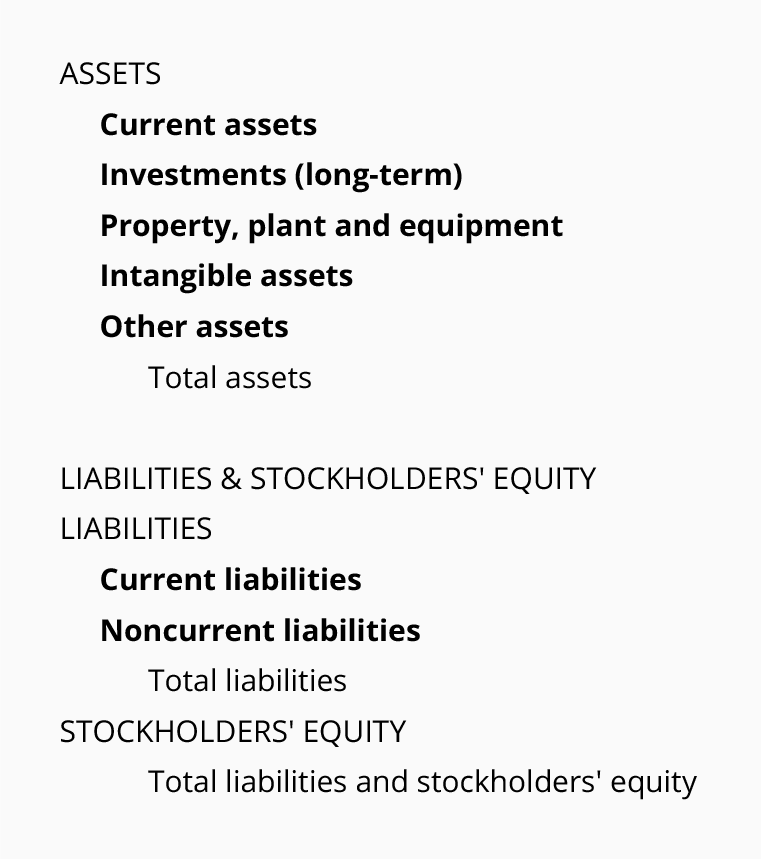

How Balance Sheet Structure Content Reveal Financial Position

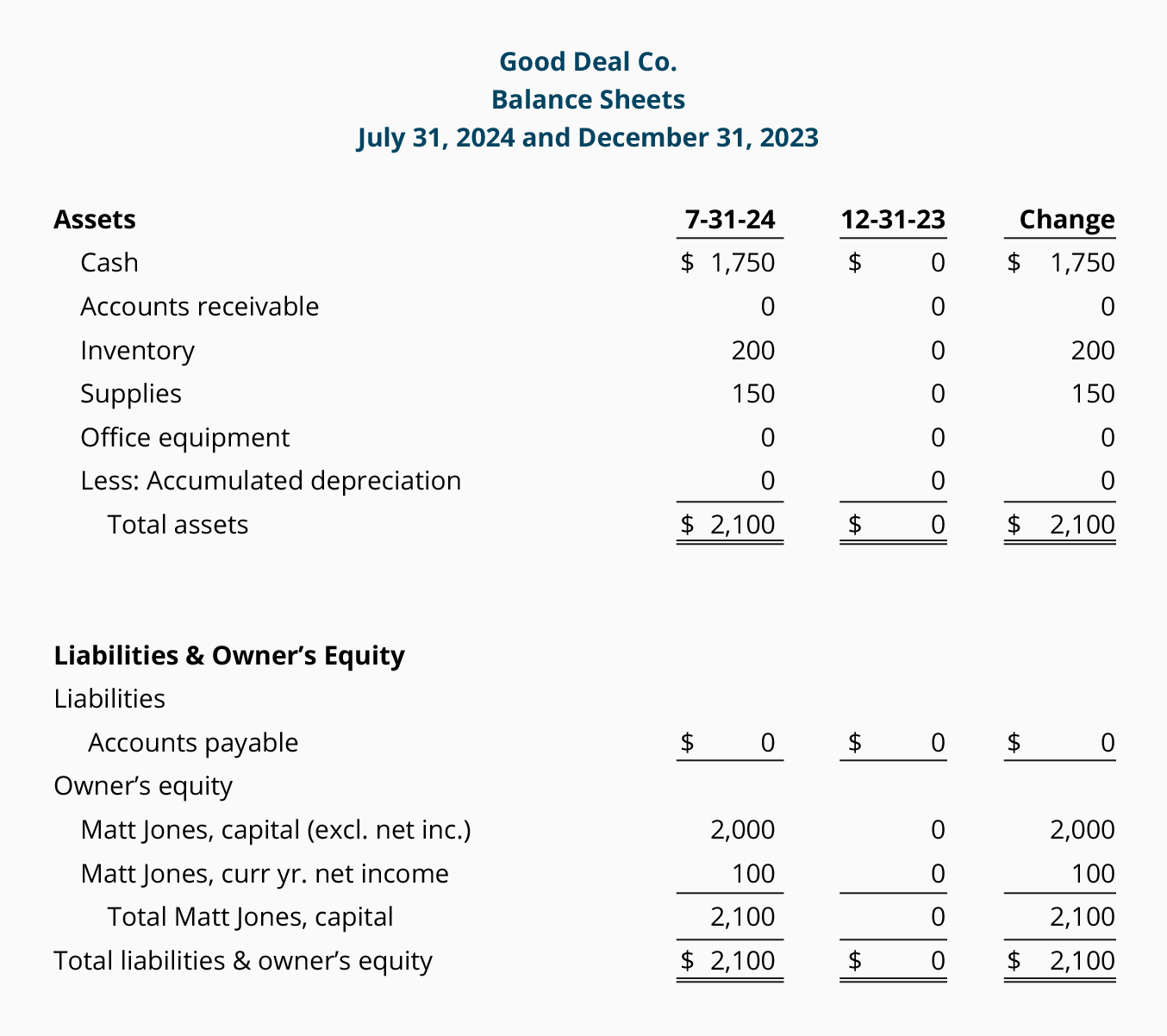

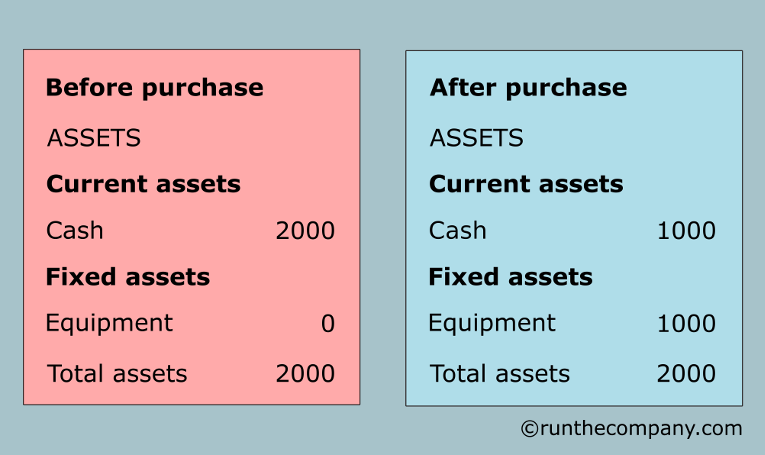

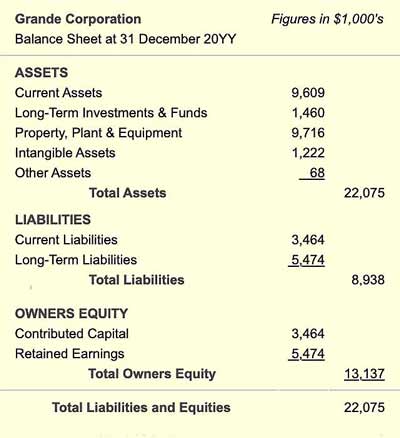

Balance Sheet Examples Runthecompany

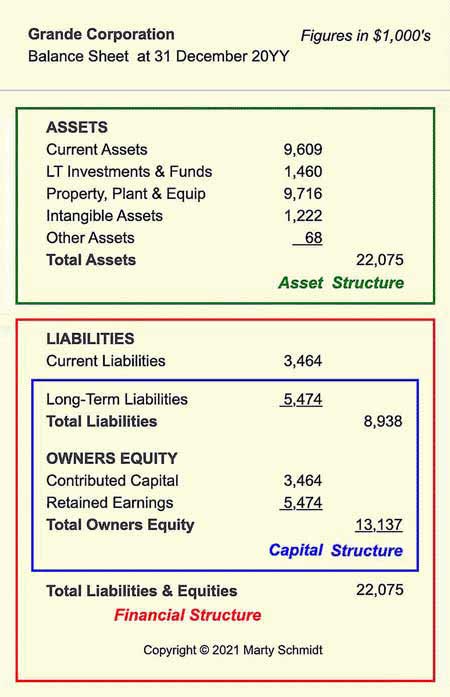

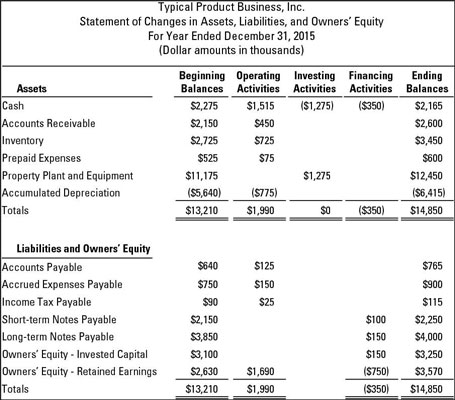

Bookkeeping Balance Sheet And Income Statement Are Linked Accountingcoach

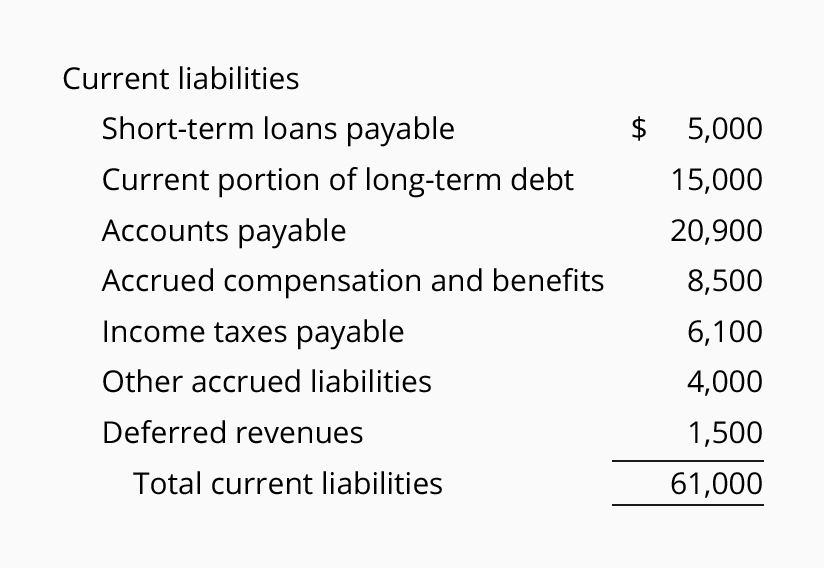

Balance Sheet Liabilities Current Liabilities Accountingcoach

Bookkeeping Balance Sheet And Income Statement Are Linked Accountingcoach

Balance Sheet Examples Runthecompany

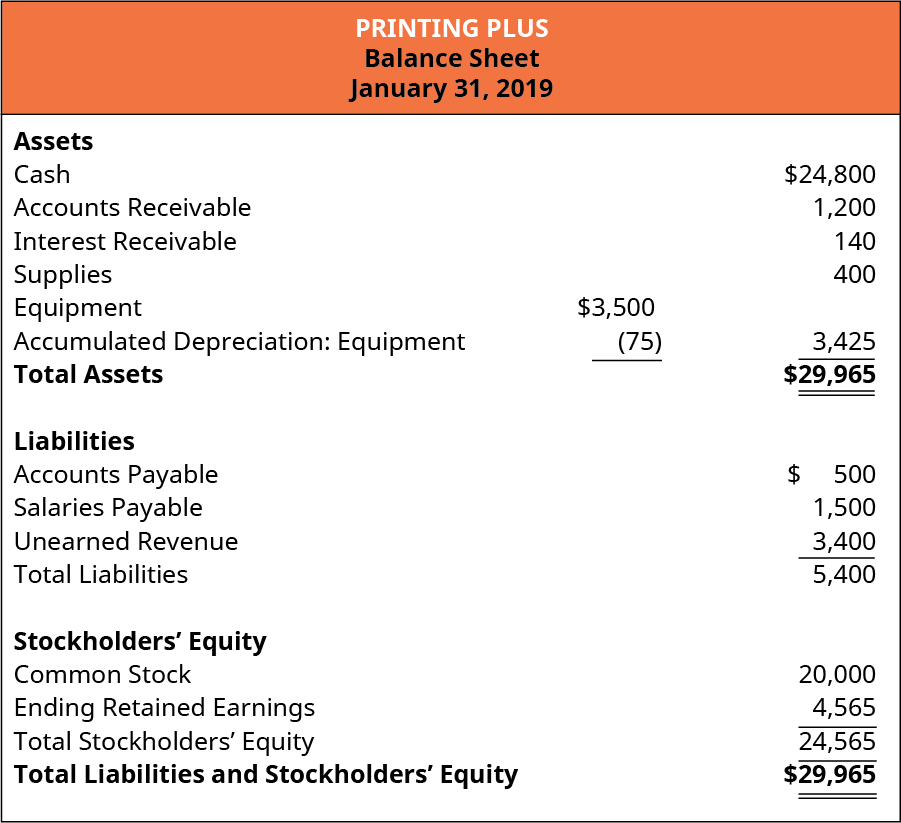

Prepare Financial Statements Using The Adjusted Trial Balance Principles Of Accounting Volume 1 Financial Accounting

Balance Sheet Examples Runthecompany

Balance Sheet Examples Runthecompany

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

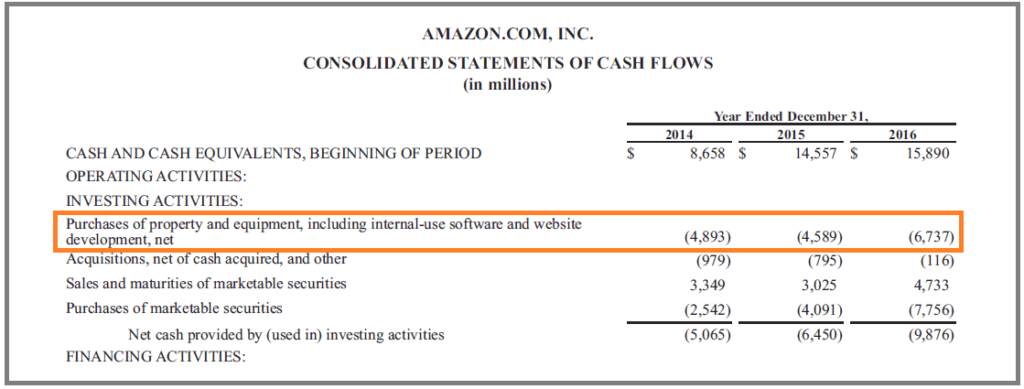

Cash Flow Statement Analyzing Cash Flow From Investing Activities

Capital Expenditure Capex Guide Examples Of Capital Investment

The Balance Sheet Boundless Finance

Changes In Balance Sheet Accounts Dummies

How Balance Sheet Structure Content Reveal Financial Position

6.jpg)

:max_bytes(150000):strip_icc()/GettyImages-172940273-28a7232c2a9149a9a191440b7b8a397c.jpg)